China's Foundry Industry Development 2015-2019

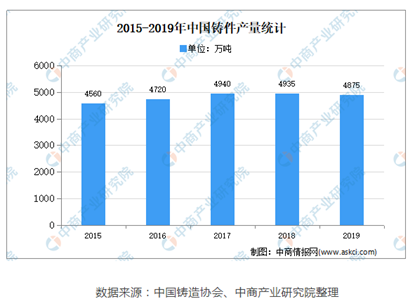

Since China surpassed the United States as the world's largest producer of castings for the first time in 2000, it has remained the world leader. In 2015, due to changes in the national macroeconomic environment, the total output of castings in China experienced negative growth for the first time, with a year-on-year decrease of 1.30%. In 2016 and 2017, stimulated by the increasing downstream demand for automobiles, rail transportation, mining and metallurgical heavy machinery, and engineering machinery, the production of castings in China has resumed its growth trend. In 2019, the output of castings in China reached 48.75 million tons.

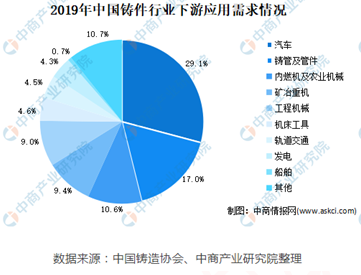

In 2019, the market demand for engineering machinery, cast pipes and fittings, rail transportation, and mining and metallurgical heavy machinery in China's casting industry increased, while the demand for automotive casting decreased, with a proportion of 29.1% in 2019. The market share of industries such as agricultural machinery, machine tools, and power generation equipment has also slightly decreased.

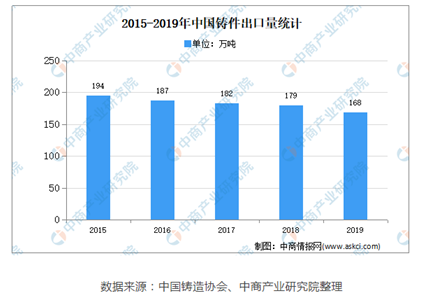

With the development of China's foundry industry and the improvement of casting technology, casting products have transitioned from primary products to high-tech and high-value-added products such as wind power castings and machine tool castings. However, currently, China's export competitiveness is still insufficient, with a low export proportion and an overall downward trend. Additionally, China still needs to import some high-tech casting products that it cannot produce independently. In 2019, China's casting exports amounted to 1.68 million tons, a year-on-year decrease of 6.3%.